The 15-Second Trick For Outsourced Cfo Services

Wiki Article

Not known Factual Statements About Outsourced Cfo Services

Table of ContentsTax Accountant In Vancouver, Bc Can Be Fun For EveryoneThe Ultimate Guide To Pivot Advantage Accounting And Advisory Inc. In VancouverNot known Facts About Vancouver Accounting FirmSmall Business Accounting Service In Vancouver - The FactsThings about Vancouver Accounting FirmThe Buzz on Small Business Accountant Vancouver

Here are some benefits to working with an accounting professional over an accountant: An accountant can offer you an extensive sight of your organization's monetary state, together with approaches and also referrals for making economic choices. Bookkeepers are only liable for videotaping financial transactions. Accounting professionals are called for to complete even more schooling, accreditations and also job experience than accountants.

It can be difficult to determine the ideal time to work with an accountancy specialist or accountant or to figure out if you need one in all. While several little organizations employ an accountant as an expert, you have several options for taking care of economic tasks. Some little business owners do their own bookkeeping on software program their accountant suggests or makes use of, supplying it to the accountant on an once a week, monthly or quarterly basis for action.

It may take some history research to discover an appropriate accountant due to the fact that, unlike accountants, they are not called for to hold an expert qualification. A strong recommendation from a relied on colleague or years of experience are crucial variables when working with a bookkeeper.

7 Simple Techniques For Small Business Accountant Vancouver

For little organizations, experienced money monitoring is a critical facet of survival and also development, so it's sensible to deal with a monetary specialist from the beginning. If you like to go it alone, think about starting with accountancy software application as well as maintaining your publications diligently as much as date. That way, ought to you require to work with a professional down the line, they will have exposure right into the full monetary history of your service.

Some resource interviews were conducted for a previous variation of this write-up.

Outsourced Cfo Services for Dummies

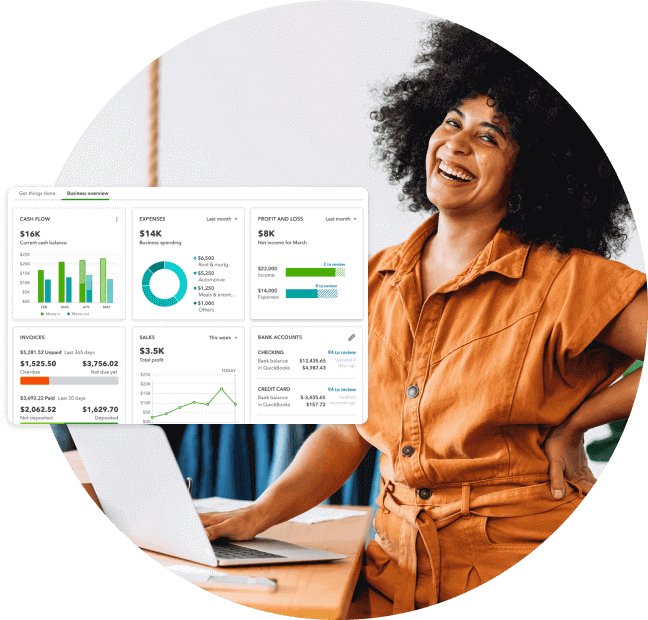

When it concerns the ins as well as outs of taxes, audit and financing, nonetheless, it never injures to have a seasoned expert to count on for assistance. A growing variety of accounting professionals are additionally caring for things such as cash circulation forecasts, invoicing and also HR. Inevitably, many of them are tackling CFO-like roles.For instance, when it pertained to obtaining Covid-19-related governmental financing, our 2020 State of Small Company Study discovered that 73% of small organization owners with an accounting professional stated their accounting professional's advice was essential in the application procedure. Accounting professionals can additionally aid company proprietors prevent pricey blunders. A Clutch survey of little business owners programs that greater than one-third of local business list unexpected expenses as their leading financial obstacle, adhered to by the blending of business as well as you can find out more individual funds and also the inability to receive repayments in a timely manner. Small business owners can expect their accounting professionals to assist with: Choosing the company framework that's right for you is essential. It influences how much you pay in tax obligations, the documentation you need to file and also your individual liability. If you're looking to convert to a various company structure, it can cause tax consequences and various other complications.

Also business that coincide size and sector pay really various quantities for accounting. Before we enter buck figures, let's discuss the expenditures that go right into local business accounting. Overhead expenses are expenses that do not straight become an earnings. These prices do not transform into cash money, they are necessary for running your organization.

The Ultimate Guide To Tax Accountant In Vancouver, Bc

The typical price of audit solutions for tiny organization varies for each special situation. The ordinary monthly accountancy charges for find out here now a tiny service will climb as you add more services and also the jobs get tougher.You can videotape purchases as well as procedure payroll making use of on the internet software program. You get in quantities into the software program, and also the program computes overalls for you. Sometimes, payroll software for accountants allows your accountant to supply pay-roll handling for you at really little additional expense. Software program options are available in all forms and dimensions.

Fascination About Pivot Advantage Accounting And Advisory Inc. In Vancouver

If you're a new company owner, do not fail to remember to element bookkeeping costs right into Recommended Site your budget plan. If you're a veteran proprietor, it may be time to re-evaluate bookkeeping costs. Management costs as well as accounting professional charges aren't the only accountancy costs. tax accountant in Vancouver, BC. You should also take into consideration the impacts accounting will carry you as well as your time.Your time is additionally useful and also ought to be considered when looking at accounting costs. The time invested on audit tasks does not generate profit.

This is not intended as legal advice; to learn more, please click right here..

Some Known Facts About Small Business Accountant Vancouver.

Report this wiki page